Since its launch in 2004, Facebook has been rolling out new features and technologies significantly.

One of the latest and advanced add ons in the Facebook ecosystem is Facebook Pay. But do you know how does Facebook Pay work?

How to receive money on Facebook Pay for all your business transactions?

What are the benefits of using Facebook Pay?

Well, don’t worry. We got you covered.

Undoubtedly, Facebook Pay can transfer funds between friends and family, but it is also a great asset for your online business.

But before we jump into the nitty-gritty aspects of Facebook Pay and how it’s a great tool for your business, let’s get our basics sorted out.

What is Facebook Pay?

With the change in consumer buying behavior, digital transactions have been at an all-time high. People love online shopping and are looking to use platforms that make their payment process fast, secure, and easy.

Facebook jumped in to fulfill the demands of 21st-century users with a highly advanced platform, Facebook Pay. Since its launch in 2019, Facebook Pay has proven its performance.

It is a secure and agile transaction platform available on Facebook, Instagram, and Messenger in the U.S. You can also use Facebook Pay primarily using Facebook in countries located in Asia, Africa, Latin America, Canada, and the Middle East.

Facebook is planning to integrate Facebook Pay in WhatsApp to increase its user base. If you are highly active on Facebook, Instagram, and Messenger for your social media marketing, you need to add Facebook Pay as a payment option to make the sales process easier for the audience.

Your online sales strategy will attract more transactions and profits if you decide to increase your payment scope with Facebook Pay.

Now that we are clear about Facebook Pay let’s dive a bit deeper and understand how Facebook Pay works?

How Does it Work?

It has a similar payment model compared to other platforms, like Zelle and Venmo. It is an end-to-end encrypted transaction platform that helps all its users to make purchases or donate money in the Facebook ecosystem.

The only standout aspect it brings in is that it can be only used by Facebook, Instagram, and Messenger users.

The entire Facebook ecosystem has 3.5 billion users eligible to access it once Facebook integrates it with WhatsApp. Facebook alone attracts 2.9 billion active users every month.

With these staggering numbers, chances are a major half of your target audience are already using it which means that you have a great opportunity to attract all the users of Facebook, Instagram, and Messenger to buy from your marketplace and online store.

Once a user signs up for it, the platform asks for their credit or debit card information to avoid any hiccups during every transaction made using it. Every single transaction will be a few clicks to save time and effort.

It can be used for:

- Buying tickets for events

If you have an event listed on Facebook or Instagram, you can increase your sales and fill up your slots if you accept payments through it.

People will pay you the money within a few steps without disturbing their experience of using the Facebook ecosystem.

- Purchase on Instagram and Facebook marketplace

If a user is scrolling through your marketplace on Facebook or Instagram, they can purchase your products easily if you accept payments through it.

- Donation to fundraisers and charity

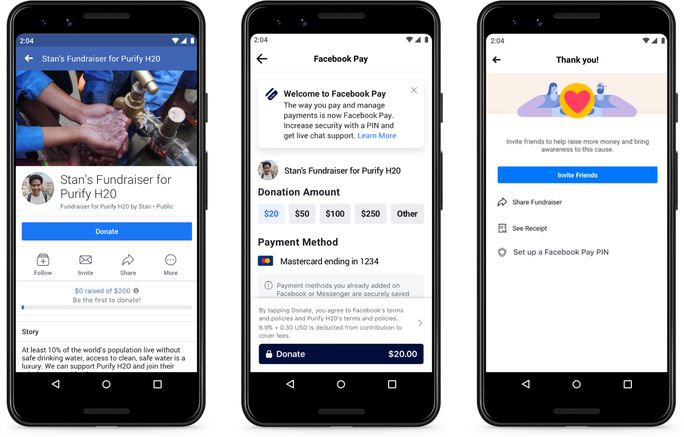

If you have a fundraiser or charity organized on Facebook, Instagram, or Messenger, people will find it easy to donate using it.

Here’s an example of how a user can donate on Facebook through it.

- In-game purchases

It is also eligible for all game lovers on Facebook. If you have an online game on the Facebook platform, it will be easier for all the gamers to purchase in-game things using it.

It will avoid the hindrance caused to open up their wallets and type in their card details every time they want to purchase on Facebook.

- Friend-to-friend payments

Apart from all the business aspects, it can also easily transfer money to friends and relatives.

Facebook doesn’t want its users to hinder their experience of using the Facebook ecosystem to make a transaction successful. It is a great way to transfer money to friends, shop through its marketplace, and be active in donations on its platforms.

These were some things that it brings to the table, but how can your business make the most of it?

Let’s highlight its benefits for your business.

What are its Benefits?

There are many benefits that a business owner can drive using it, but here are a few highlights:

- Increased transactions

You’ll notice an increase in the transaction numbers if you accept payments through it. Being on Facebook Marketplace will enable you to interact with audiences who are eligible to use it.

If a Facebook or Instagram user likes any of your products, you don’t want to lose that opportunity; you want them to take the buying action quickly before changing their minds.

It will make the transaction process simpler and swift, which will result in attracting more customers.

- Boost in user base

Once you enable it as a money exchange for your online business, you’ll attract more Facebook, Instagram, and Messenger users towards your store.

It will help you stand out from the rest of the competitors who are not using this amazing feature from Facebook.

After some time, the news will slowly spread among your target audience, and people will feel more happy and satisfied buying from your online space than your competitors. Your user base will increase, and you’ll have a strong community of lifelong paying customers.

- Increased brand awareness

Once you attract a wider audience base, you’ll establish a strong brand image in the Facebook ecosystem. You’ll have the edge over your rivals and a loyal customer base who trust you with their transaction process.

- Skyrocket profit & sales numbers

When we talk about business, it’s the numbers that matter in the end. Once you start accepting payments through it and create a huge customer base, your profits will boost.

You’ll drive in great revenue numbers, and you’ll have a solid bottom line.

So how can you set it up as a payment exchange and avail all these benefits for your online business on the Facebook ecosystem?

How to Set it Up for Your Business?

Enabling it as your payment method is not rocket science. You either need to set up your Facebook Shop, and in the settings options, you can add it as a mode of receiving payment.

You need to open the Business Manager in your Facebook Shop and then click on payments. Then click on +Add and add your payment option.

Click on continue, and then you can follow simple instructions to add different payment methods. Also, select Facebook Pay as one of the payment methods to avail all the benefits.

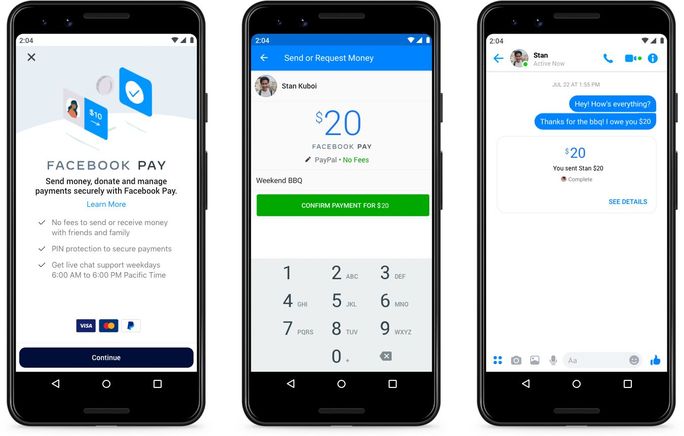

Here’s a payment example; you can see how seamlessly one user paid an amount of $20 to another user using Messenger.

You can also receive payments from your customers while Instagram checkouts, Messenger conversation, or Facebook Marketplace selling.

Is it Safe to Send or Receive Money Through it?

It is extremely serious about the user experience and their money.

It links with third parties and affiliate partners to make any payment successful. But Facebook has clearly stated in its privacy policies that they’ll share limited personal information with the vendors to keep the users’ privacy intact.

There are several measures that Facebook has implemented to ensure that the transactions happening on its platform are safe and secure.

Here’s what Facebook implemented as its security wall:

- Anti-fraud technology monitoring: It will notify you in case of any suspicious transaction happening in your account. Highly advanced technologies are used to ensure the safety of your money.

- Supportive customer support: You have the freedom to report any miscellaneous transaction happening through your account to Facebook professionals 24*7 via email. You can also connect with a customer support agent on live chat during Pacific Time between 6 a.m and 6 p.m.

- Data safety: All the payment data is safe and secure and has highly robust encryption. No data is shared between the customers, sellers, buyers or merchants without the consent of the users. The storage of the payment data is kept separately compared to the account data.

- Secure verification: It enables you to protect your account with a PIN or biometric verification so that there is no breach in security.

- Transaction notification: The receiver and sender will be notified of the transaction to ensure no discrepancies in the transaction process.

- Privacy: Transaction details are confidential, and no information is shared across any touchpoints on the Facebook ecosystem unless the sender chooses to share.

Should You Use it for Your Business?

With so many platforms offering benefits to businesses for seamless transactions with their customers, it is hard to choose one transaction platform. Instead, you can have multiple payment platforms for your business. But make sure you include Facebook Pay in your list to make the sales process easier for the users of the Facebook ecosystem.

You can also inform your audience that you have included Facebook Pay in your payment methods to get them excited and to enable them to make swift transactions to purchase your products. The easier you’ll make the customer journey, the more you’ll achieve your desired business outcomes.

If you need to solidify your overall social media presence, you can use SocialPilot to schedule easy social media content, create a content calendar, and curate your content.

With its highly advanced social media management and optimization features, SocialPilot is one of the most powerful social media tools you’ll come across.